Oral care products – guardians of oral health

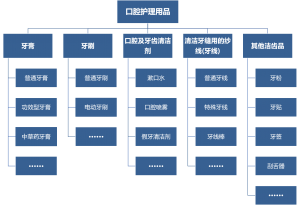

Oral care products refer to daily products that act on human teeth, oral mucosa or dentures by washing, gargling, rubbing, spraying, scraping, sticking or other similar methods to achieve cleaning, reducing bad odors, modification, maintenance, and keeping them in good condition. Oral care products can be roughly divided into five categories: toothpaste, toothbrush, yarn (dental floss) for cleaning between teeth, oral and dental cleaners, and other dental cleaning products.

Classification of oral care products

Source: Drawn by the Sullivan Institute

The industry market size is growing steadily, and the segment has a high share of toothpaste and toothbrushes

Toothpaste and toothbrush are the most important categories of oral care products in China, accounting for nearly 80% of the oral care products market share. The unit price of toothpaste and toothbrush is relatively low, but as a daily necessity, it has rigid demand and is positively correlated with population growth, and the market is relatively stable. As a country with a large population, China is the largest consumer of toothpaste and toothbrushes. In recent years, the increase in health awareness among residents has prompted consumers to increase the frequency of tooth replacement, and also increased the demand for multi-function toothpaste. In recent years, China's toothpaste production has increased from 517,000 tons in 2013 to 619,000 tons in 2017, and toothbrush production has increased from 7.02 billion in 2013 to 7.94 billion in 2017, maintaining stable growth.

The development of other oral care products is also promising. On the one hand, the increase in the income of Chinese residents has increased the consumption capacity of residents, and the consumption structure has changed from the subsistence consumption based on clothing, food and housing in the past to the development and enjoyment type. Residents' awareness of health and nursing care continues to increase, providing development opportunities for oral hygiene and care products such as dental floss, dental floss sticks, and mouthwashes. On the other hand, the improvement of living standards has caused changes in the dietary structure of residents, and the intake of refined sugary foods and sugary beverages such as cakes and biscuits has increased, which has increased the risk of caries and increased oral problems in China. Therefore, with the change of residents' consumption structure and diet structure, consumers' demand for oral care products will increase day by day, and the market size of oral care industry will increase from 40.79 billion yuan in 2013 to 47.12 billion yuan in 2017.

China Oral Care Products Market Size, 2013-2022 Forecast

Source: fsTEAM Software Editor, Sullivan Data Center Compilation

Economic, political, technological and other factors continue to drive the development of the industry

Driven by a number of factors, the oral care products industry has always maintained stable development, and the future of the industry is bright.

In terms of economic factors, China's economy has maintained stable growth in the past five years, residents' disposable income has continued to increase, and residents' living environment has been effectively improved. With the continuous improvement of residents' living standards, consumers' awareness of oral care has been strengthened, and they tend to be more professional and scientific oral protection, which is specifically reflected in the increasingly perfect way of oral care, in addition to mainstream oral care categories such as toothpaste and toothbrushes, oral care peripheral categories such as mouthwash, dental floss, tooth powder, and dental care have also shown a rapid growth trend.

In terms of political factors, China has issued a number of national and industry standards, which mainly include product standards, basic general standards, management standards, and method standards related to toothpaste, tooth powder, oral cleaning and care liquid, denture cleaner and other categories, guiding the healthy development of the industry. In addition, the two-child policy has also promoted the development of the oral care products industry. With the implementation of the two-child policy, the number of newborns has increased. Sullivan data shows that more than 60% of children in families have experienced oral problems, and 66% of 5-year-olds suffer from dental caries, 97% of which are untreated. As the main user group of oral care products, the increasing number of children will increase the demand for oral care products.

In terms of technical factors, on the one hand, the development of Internet technology has led to the rapid development and popularization of e-commerce and third-party payment, and now online shopping has gradually become a mass consumption mode from an online fashion. According to data from the Ministry of Commerce, China's e-commerce transaction volume reached 29.2 trillion yuan in 2017, a year-on-year increase of 11.7%. Oral care product brands have begun to deploy sales and marketing on online platforms, opening online flagship stores on platforms such as JD.com and Tmall, and conducting product portfolio promotions and buying and giving activities from time to time. On the other hand, China's oral care products production technology closely follows the international market level and has made a series of technological breakthroughs. For example, the material of the toothbrush has changed from natural mane to synthetic nylon silk, dental floss has evolved from ordinary dental floss to water floss, and the effect of toothpaste has evolved from ordinary anti-moth, whitening to preventing tooth decay, refreshing breath, and inhibiting harmful oral bacteria.

Foreign brands lead the industry, and local companies are catching up

The oral care products industry has a long history of development abroad, toothpaste, dental floss, mouthwash and other products are from abroad, so the strength of foreign oral care products enterprises is stronger. At present, the domestic market for oral care products is mainly divided into three echelons, the first echelon is mainly composed of international well-known industry giants such as Procter & Gamble, Colgate, Unilever, etc., with a leading market share. The second echelon is composed of local leading brands such as Yunnan Baiyao and Bejiajie, and the brand awareness is lower than that of the above-mentioned multinational enterprises. The third tier is made up of a number of regional brands.

Due to the low threshold of the oral care products industry, there are many domestic manufacturers, serious product homogenization, and fierce competition between them. Oral care products need to be in direct contact with the mouth and closely related to oral health, so consumers have more trust in well-known brands when choosing products, and well-known brands in the industry tend to be more dominant. Compared with well-known foreign giants, Chinese enterprises are lacking in financial strength, brand strength and technical strength, so the business of local enterprises is mainly concentrated in China, although some enterprises have export business, but most of them are engaged in OEM/ODM business, OEM processing for foreign brands, and their own brand development and publicity are not enough, and market expansion needs to be improved.

However, in the past ten years, in the face of the situation dominated by foreign-funded enterprises, domestic enterprises are also carrying out their own brand construction in the case of developing OEM/ODM business, and gradually forming a certain popularity in the Chinese market. Although foreign giants occupy the main share of the mid-to-high-end market, local enterprises have also begun to move from the low-end market to the high-end market through a differentiated marketing management model that meets the needs of market segments, and some leading brands have been recognized by consumers and occupy a certain market share. Taking the toothpaste market as an example, local Chinese brands such as Yunnan Baiyao, Shuke and Naes have grown strongly and have become well-known brands in the Chinese market.

In addition to traditional TV advertising, print advertising, image spokesperson and other branding methods, many local enterprises are also actively integrating media communication to promote brand building. For example, Denkang's toothpaste brand Leng Sour Ling joined hands with Alipay, Tencent QQ and other Internet giants to carry out brand marketing during the Spring Festival to shape its own brand and improve brand awareness. Through the Alipay service window, Cold Acid Ling pushes the Alipay red packet password to consumers, distributes red envelopes to consumers, and automatically pays attention to the Cold Acid Ling service window after consumers scan the QR code, so as to achieve the purpose of brand promotion. In addition, Yunnan Baiyao toothpaste differentiates into the toothpaste market and shapes its own brand image through selling points such as bleeding gums, mouth ulcers, and swollen and painful gums. The hotel toothpaste brand two-sided needle establishes a "customer echo system" according to its business characteristics, maintains communication with customers, actively understands customer needs, and improves and optimizes its own products and services according to customer questions, suggestions and other feedback, so as to enhance the brand image in the hearts of customers.

Functional products and high-end products will be more favored in the future

With the strengthening of consumers' awareness of oral health care and the gradual enhancement of product purchasing power, in the consumption of oral care products, consumers have higher and higher requirements for the quality, function and quality of products, prompting oral care products enterprises to launch more functional and more high-end oral care products to meet consumer needs.

In terms of oral cleaners, influenced by the consumption concept of Europe and the United States and other countries, mouthwash is gradually accepted by Chinese consumers, and the consumer group of mouthwash is increasing, and the market scale is expanding. Sullivan data shows that from 2015 to 2017, the compound growth rate of China's mouthwash market reached 85%. In terms of toothbrushes, electric toothbrushes, as a new type of toothbrushing tool, have been growing in China in the past five years. According to Sullivan data, China's electric toothbrush production in 2017 was about 6.287 million, an increase of 20.8% from 5.203 million in 2013, and a compound annual growth rate of 4.8%; In terms of toothpaste, China's toothpaste market has gradually developed from a single clean toothpaste to four categories of toothpaste products, including clean, white, anti-caries, and pharmaceutical (including Chinese and Western medicine).

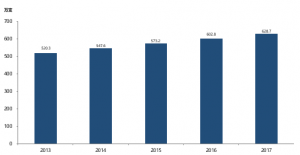

China's electric toothbrush production, 2013-2017

Source: fsTEAM Software Editor, Sullivan Data Center Compilation

Dr. Wang Xin, Global Partner of Sullivan, Vice President of Global Market Strategic Planning and President of China Region, pointed out that the sustainable development of China's economy, continuous policy support, and technological progress have provided long-term development momentum for the industry, but there is still a certain gap between domestic local enterprises and foreign-funded enterprises, and local enterprises need to continue to adhere to differentiated operations, and grasp the future trend of the industry, and bring functional products and high-end products to consumers in order to stand out in the competition with foreign-funded enterprises.